OptionsHawk 2020 Option Day Trading Challenge

Some of you may have seen my post earlier this week regarding a new challenge for 2020 involving flipping option contracts intraday as a way to add daily capital gains without any overnight exposure.

The experiment involves roughly $5000 capital outlay positions and seeking 15% intraday modest returns. The candidates for entry are names that trigger the many technical level alerts I set each night and also tend to have an option flow bias referencing the OptionsHawk Database for confirmation. On days without many technical triggers I will also look at hot opening hour option flow names.

Some more parameters include mainly looking at 3-60 days expiry and with the objective to be out daily the shorter time-frame makes the most sense to avoid overpaying premium. I also am mainly looking at 40-60 Delta calls (or negative Delta on puts) and contracts in the $0.50 to $3 range with 100 to 15 contract positions respectively. I am also needing fairly liquid options, tight bid-ask spreads, and some open interest of note. Ideally finding lower IV names with rising IV’s due to flow will add the extra kicker for enhanced profits.

In terms of risk management I am taking a few angles, looking to have a max stop loss near 25% which is based on my 10+ year historical win-rate on trades near 70%, allowing for infrequent losses to be wider than the frequent gains. I am also utilizing short-term trading charts with 30 minute candles with VWAP based Bollinger Bands, a 9 EMA, and ATR trailing stop on 19 periods with a 1.5 ATR factor. A 30 minute close below the lower Band or the ATR stop will trigger an exit.

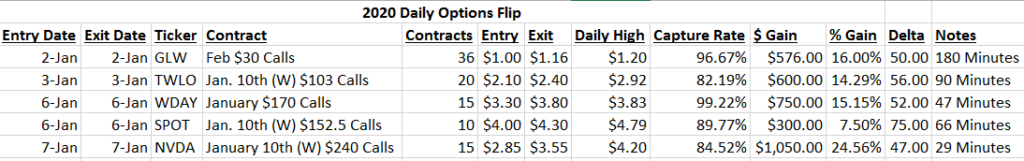

I am off to a solid start with 5 wins on 5 trades for +$3,276. I have had a number of requests already to offer this as a service, or if this is included with OptionsHawk, and that is not really a direction I am looking right now. First, I want to get a much larger sample size on refine/tweak the strategies and secondly this is more of an example of one of the many ways to make money as an OptionsHawk Max member. We are providing the fastest, most accurate options flow daily and with catalyst/fundamental color while also providing technical set-ups and triggers all day every day. All of these trades below were names that triggered with a technical alert in the Trading Hub first. The goal of our services are to provide traders with idea generation via fundamental, technical, and option flow research, not to recommend trades as each person should follow his/her own strategies and implement our research into his/her process. These trades over 4 days would nearly cover the ANNUAL cost of a membership.

The only downside so far has been it adds an extra distraction of yet another thing I need to monitor, but thus far the trades have been hitting targets in very short time-frames. The goal is keep at this, though it will be considerably more difficult during earnings season, and provide a weekly update to this blog post.

Update 1/17/2020

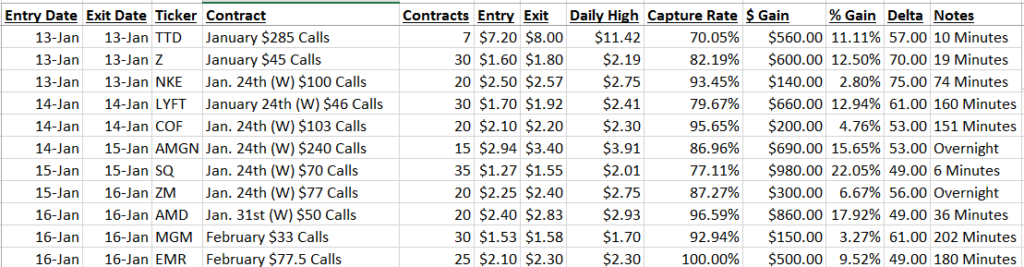

11 more trades this week and 11 more wins!

Update 1/24/2020

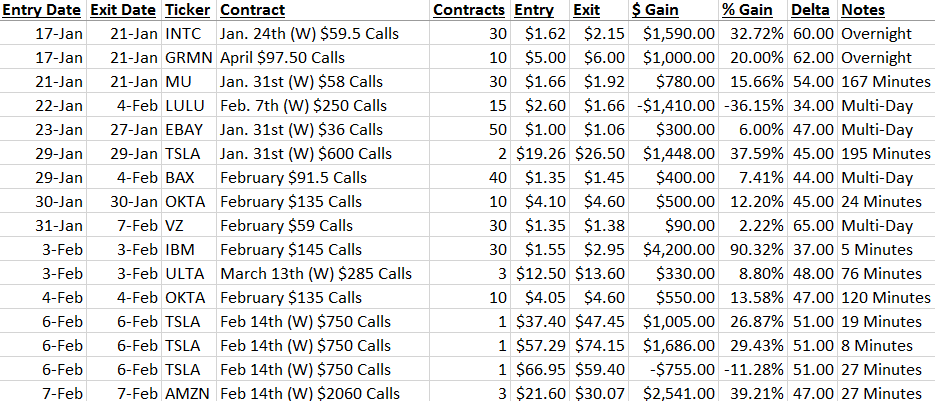

No major updates, cashed out of INTC, MU, GRMN calls on 1/21 to move to 24 straight wins. Not as many opportunities this week, the news-driven chop from the Coronavirus making intraday trading trickier, sitting on some EBAY, RH, EBAY calls to hold until next week.

Update 2/7/2020

Things got a bit crazier, earnings season distracts me and keeps me pretty busy and slowed down on some trades with Coronavirus headlines causing increased volatility, but got back in a groove this week a bit, streak ended, now at 35 wins, 2 losses for +$27,491.

Thanks for Following!

Joe

0 Comments